One might think that estate planning is an easy task and does not require absolute attention. At the end of the day, it just helps in making a document called the will that talks about the distribution of your wealth and obligations. But is it that easy? If so, then why does it tend to create conflicts between the heirs of the wealth?

Why are several cases of fraudulent activities from attorneys and family members being reported? All these factors tell us that this task is not to be taken lightly. There are certain steps that you need to consider before you start estate planning.

This article will expand your knowledge about these steps. Those who are alien to the concept of estate planning would also benefit from this article.

What Is Estate Planning?

When someone hears the news of a severe medical condition or if someone prefers to have a game plan for all the future stages and stays cautious, they tend to involve themselves in estate planning. Planning about the preservation and distribution of your wealth and debt is as important as planning about your career, your wedding day, or even the future you want your children to have.

Estate planning is conducted so that the individual can decide beforehand who they want to provide a proportion of their wealth. They plan about the heirs, the organizations, trust foundations, etc. They also decide upon how much each person is going to get in the will.

Now that you know what estate planning is, you must understand all the important steps that are to be followed. These have been discussed down below.

Evaluating The Tangible Assets

You must have an inventory of assets. The tangible assets are those that have a physical presence and can be seen. These assets are also durable and hold a high value which makes them valuable investments. Tangible assets include their house or any real estate property. It also includes any automobile that the individual owns.

At times individuals tend to invest in expensive boats and yachts as well. If they have invested in any expensive piece of art, such as paintings, antiques, and sculptures, then these items can be evaluated.

Evaluating The Intangible Assets

These assets do not have a physical presence but are still quite valuable. Nowadays, the trend of bitcoin or digital currency is at its peak. These can be inherited easily. Moreover, if the individual has invested in bonds and stocks of any company, then those can be passed on as well.

Different terms and conditions of life insurance also state that these can be transferred. If you own a business, then the ownership rights can be transferred as well. Evaluating the value of intangible assets is a lot more difficult.

Requirements Of Your Family

This is an important factor while you are estate planning. In this step, you need to account for all the requirements of your family. You need to see your current financial standing by evaluating your assets in the first step and then see if the current finances would be able to meet your family’s needs.

If there is no caretaker of your children except for you, you need to see to whom you will transfer the guardianship. This is done in the case of minors. You need to run a background check on the couple. If you are worried about your children’s future, how they will meet their goals by getting into a certain university etc., you need to set aside a particular amount for this.

Necessary Legal Directives

You have to involve certain third parties in this planning process. Your first step, in this case, should revolve around searching for an estate planning attorney. You must make sure that the attorney is trustworthy and would not show any bias when guiding you about the distribution of your wealth. After your demise, they would not tamper with the documents of the will and trust.

The attorney would also help you to clear out your debt obligations and pay taxes on your behalf. You can also hire an attorney that would cater to your medical care decisions in case you are not able to do it for yourself.

Deciding The Beneficiaries

You need to make sure that you make smart decisions about who you want to make a part of your will. You need to make sure you do not fall under or overcompensate. You need to assess the age of the person and their relation with you before deciding upon the percentage amount that would go to them.

If you want to give some portion of your wealth to charity organizations, make sure they are reputable enough and can be trusted that they would not eat your money and would rather spend it in the right desired way.

In your will, do not leave any portion that talks about beneficiaries unfilled. You need to fill it out because otherwise, the state you live in would make decisions on your behalf. These decisions would have the state’s best interest at heart.

Analyzing The Prevailing Tax Laws

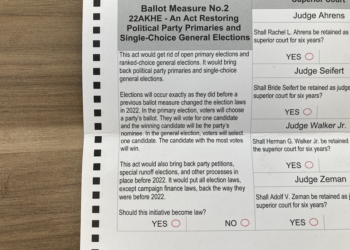

The tax laws for every state tend to differ depending on several factors. You need to make sure that you have in-depth knowledge about these tax laws. There might be a scenario in which, upon inheritance, your children would have to pay taxes because it is a requirement at the federal level.

There might also be a scenario in which your estate property would be liable for tax. For example, in 2022, if the worth of your property is up to $12.06 million, you get a tax exemption. You need to know what would happen if the property costs more than that.

Degree Of Professional Help Desired

For this, you need to see how valuable your property is. If the value of your property or wealth is high, then you might want to consider talking to an attorney. However, if your property does not have enough value and there are only a few people you want to divide your property between, then you need not look for professional help.

Revaluating The Estate Plan

There might be an instance in which you no longer require the current will because you feel a lot better than before medically. In this case, you need to reevaluate the estate plan.

Several foreign factors can impact your estate plan, such as the depreciating value of your house, etc. You need to make sure that you add and remove elements from the will depending on the prevailing circumstances.

These are all the important steps that you must consider before you plan on writing your will. These steps would make the process a lot easier for you and would make it hassle-free. It is necessary to check all the requirements because if you miss out on one of these steps, conflicts may arise after your demise.